carried interest tax rate 2021

Taxable income of 0 to 19900. The Tax Cuts and Jobs Act made some changes to the carried interest rule.

What You Need To Know About Capital Gains Tax

2021 Federal Income Tax Brackets.

. Taxable income of 0 to 9950. Tax rate Single Married filing jointly Married filing separately Head of household. Under the law funds must hold assets for more than three years for gains to be considered long-term.

Build Back Better Requires Highest Income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities

Pin By The Taxtalk On Income Tax In 2021 Communications Seizures Tech Company Logos

Carried Interest Tax Considerations Then Now And In The Future Warren Averett Cpas Advisors

Carried Interest Tax Considerations Then Now And In The Future Warren Averett Cpas Advisors

Carried Interest Tax Break For Private Equity Survives Another Attempt To Kill It 2021

Subordinated Debt Meaning Example Risk And More In 2021 The Borrowers Debt Financial Management

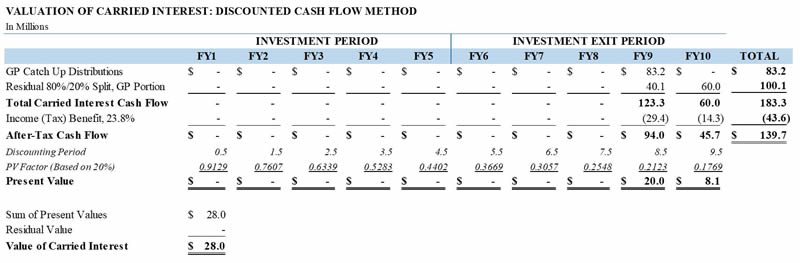

Carried Interest What It Represents And How To Value It And Why Marcum Llp Accountants And Advisors

Fact Sheet Close The Carried Interest Loophole That Is A Tax Dodge For Super Rich Private Equity Executives Americans For Financial Reform